SMSF Crypto Management With WeOnAsset

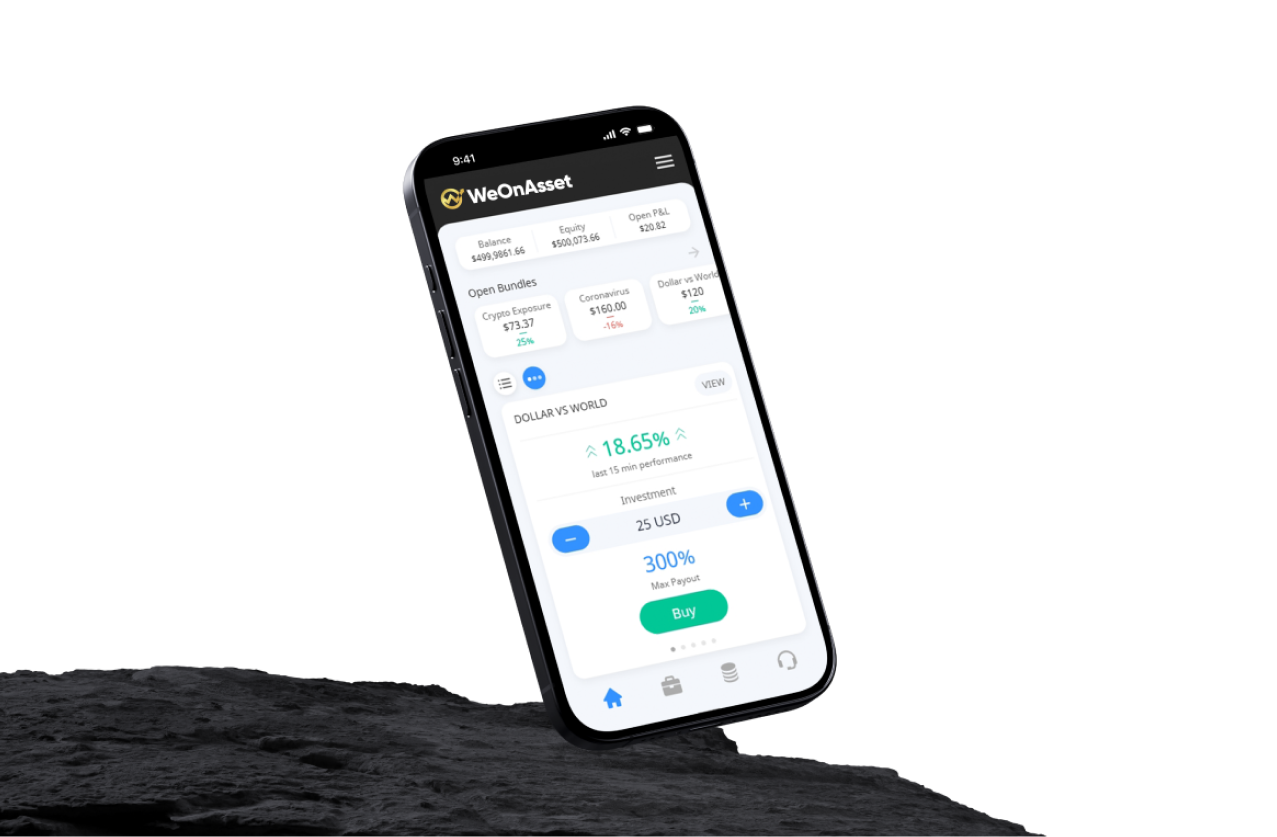

Already have an SMSF or thinking about getting set up? With WeOnAsset you can easily invest in over 440 different cryptocurrencies. Using WeOnAsset for your superannuation investments is simple and straightforward.

Benefits of using WeOnAsset to manage your SMSF

Cryptocurrency portfolio

-

Exceptional supportFriendly and local SMSF support team to assist with onboarding and customer inquiries. If you ever have any questions about how to invest in crypto with your SMSF our team is available 24/7.

-

Over 440 cryptocurrenciesHave direct access to Australia's largest variety of cryptocurrencies. With access to that amount of crypto asset you can diversify your investment strategy using your personal Superannuation.

-

Easy EOFY reportingEasily manage your tax and audit obligations with EOFY reporting. We make all things to do with taxation simple.

-

Track your portfolioRead-only API interface for accountant and fund managers to track your portfolio. We provide all the tools to make it as easy as possible for investors to manage their money.

-

OTC access

OTC (Over The Counter) services available for high volume trading with Australia's lowest fee of 0.1%. WeOnAsset makes it easy to start investing using your Superannuation. -

Trade & swapEasily swap from coin to coin using any currency on the platform. With over 380 crypto assets to swap between you have more choice when it comes to your retirement fund.

Diversify your Super

with WeOnAsset

In order to create a Self Managed Super Fund account to Buy Bitcoin on WeOnAsset you will

need the following information regarding your SMSF Trust:

-

Registered Trust Name

-

Registered Trust address

-

Trust ABN

-

A copy of the Trust deed

-

Trust beneficiary details

Get help within minutes

WeOnAsset’s locally based and knowledgeable Support Team is here for you. Both, our Live Chat and Help Desk are

available 24/7 to speak to real people everyday.

Check the latest

Information

We recommend speaking to your registered tax professional for individual advice and to

check the Australian Tax Office and Business.gov websites for the latest information. The

ATO provides tax information about using your SMSF to purchase cryptocurrencies below.

Start your journey with 3 quick steps

Frequently asked questions

-

01

Why set up an SMSF account with WeOnAsset?WeOnAsset is the easiest place to manage your SMSF cryptocurrency portfolio. Our SMSF offering provides industry leading compliance, security & customer service. Our specialist SMSF team is available to provide you with a seamless onboarding experience through ongoing account management. -

02

How do I set up an SMSF account?Before you get started with WeOnAsset you will need to establish your SMSF Trust with an applicable firm such as New Brighton Capital or one of the many others available. Once established, you will be able to set up your dedicated SMSF account with Australia’s most trusted digital currency exchange. -

03

Are my funds safe on WeOnAsset?At WeOnAsset, protection of customer assets is our highest priority. We maintain industry best practice offline storage protocols, achieved internationally recognised ISO 27001 certification in information security & provide account level security customisation.

For more information on how to keep your account secure, please refer to the below link:

https://coinspot.zendesk.com/hc/en-us/articles/333757066344-Security-Recommendations -

04

Are there risks investing with my crypto SMSF?Self Managed Super Funds are highly regulated. We recommend that you consult with a registered financial professional for individual advice before you begin your Self Managed Super fund journey with CoinSpot. Please check the Australian Tax Office and Business.gov websites for the latest information on SMSFs.